Which of the Following Are Mutually Exclusive Investments

The following mutually exclusive bartleby. 72 C Initial investment.

Project Cash Flow N A B Example 1 Consider The Following Two Mutually Exclusive Investment Projects Assume Ppt Video Online Download

Which one is the best investment.

. Assume that the MARR15a Consider the following two mutually exclusive investment projects. The following mutually exclusive investment alter-natives have been presented to. The highest IRR is always the best option which is mutually exclusive.

A mutually exclusive investment decision is defined as a situation where. 1 Easy to understand and communicate. We have two mutually exclusive investments with the following cash flows.

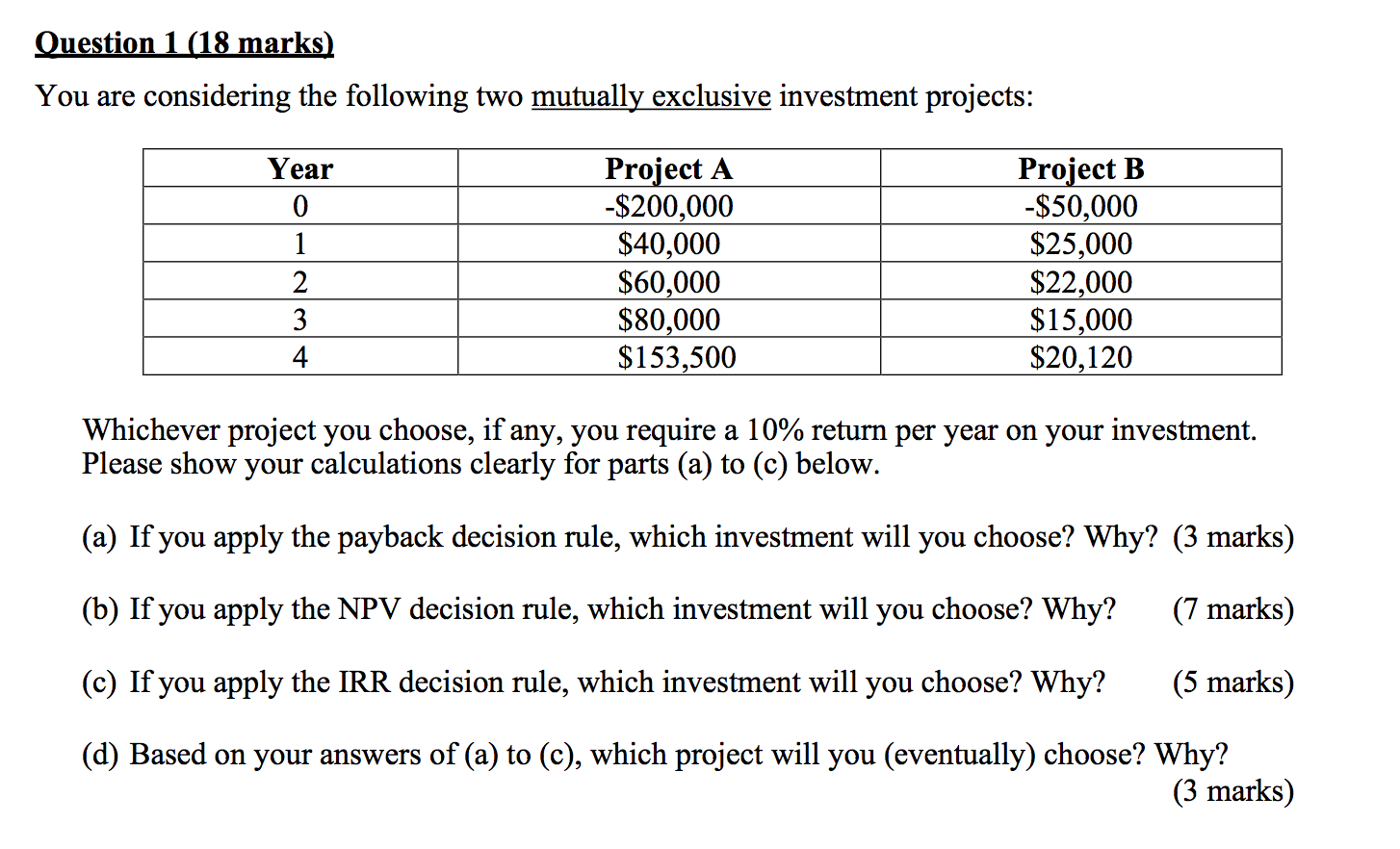

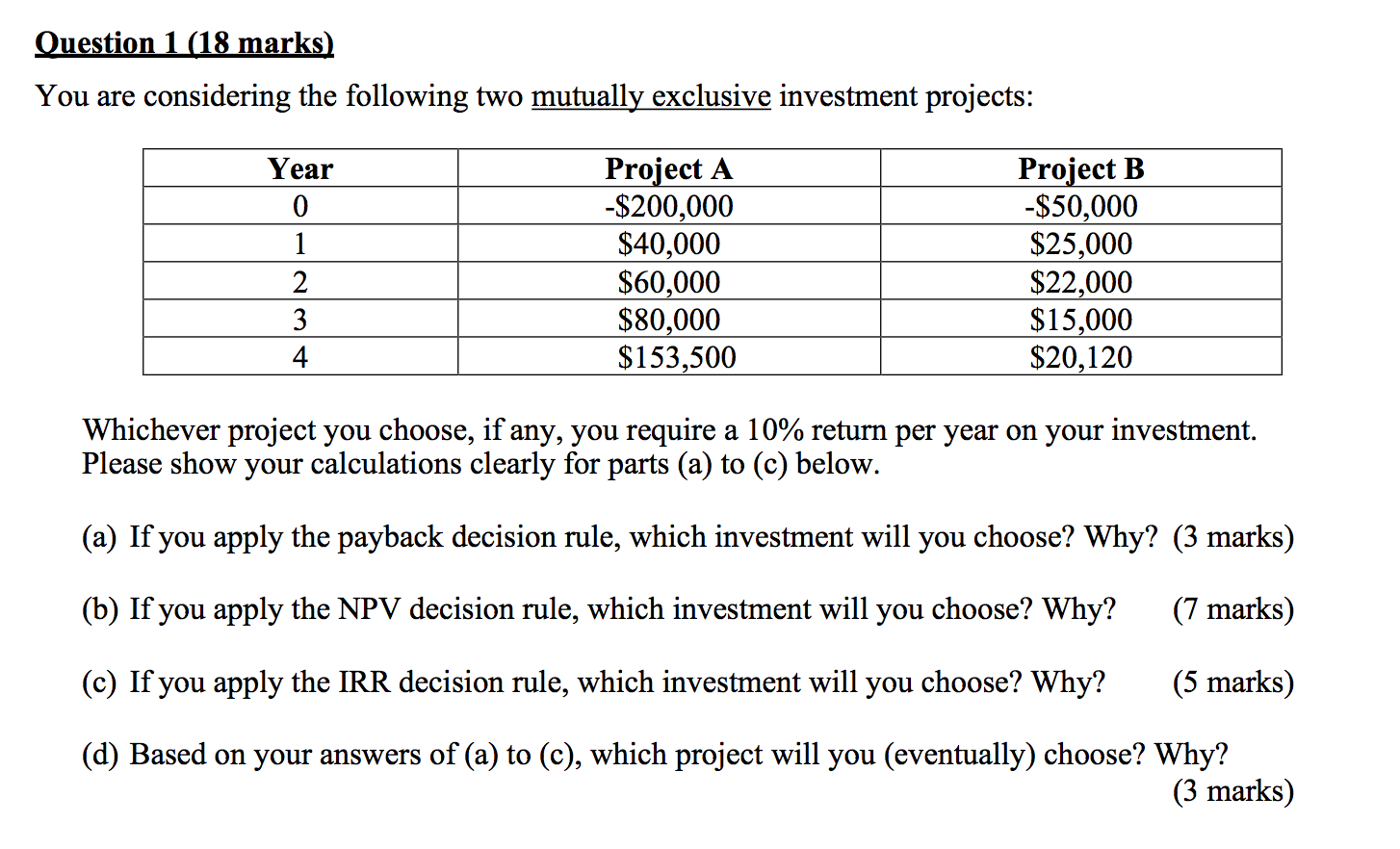

Which one of the following best expresses two mutually exclusive investments. We must choose all the high NPV projects that are exclusive for our company. Year A B 0 -25000 -25000 1 10000 0 2 10000 0 3 10000 0 4 10000 50000 Use Table II and Table IV to answer the questions.

Year A B -20000 -20000 1 10000 2 10000 3 10000 4 10000 60000 a. Which should be chosen. 254 Use the following mutually exclusive investment cash flows for the questions from COMMERACE 765 at University of Guelph.

A Choose only the best investments. An investment in project A prohibits you from investing in project B. Yingcredible Tutoring清华辅导 悉尼各大学补习专家 Mob0421556768 ADDSuite 31 Level 6 591 George St Sydney Page 12 of 25.

The rankings of mutually exclusive investments determined using the internal rate of return method IRR and the net present value method NPV may be different when The lives of the multiple projects are equal and the size of the required investments are equal. The NPV should be calculated as NPVall cash inflows initial cash outflow. What does mutually exclusive mean.

Constructing a theatre and a restaurant side by side. Compute the net present value for each project if the firm has a 10 percent cost of capital. Business Finance QA Library Two mutually exclusive investment projects have the following forecasted cash flows.

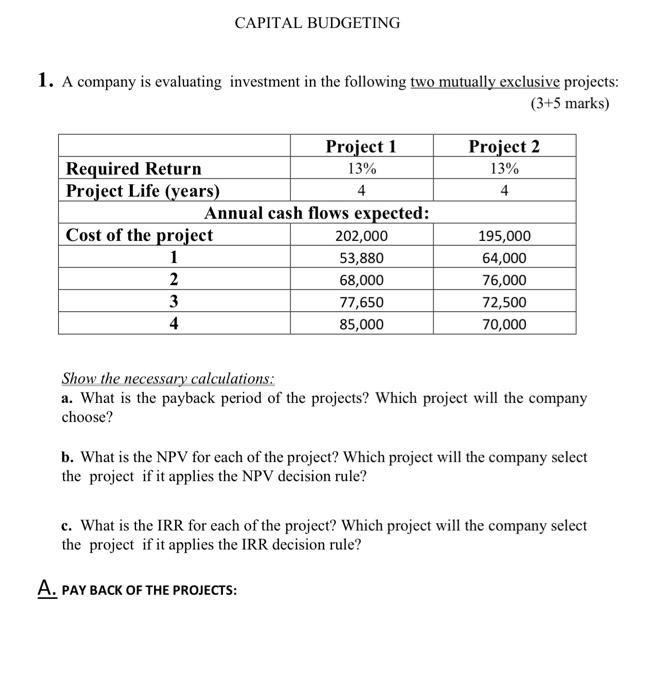

3 May lead to incorrect decisions when applied to mutually exclusive investments. Using a MARR of 15 the preferred Alter-native is. Assume that the MARR15a Using the NPW criterion which project would you selectb On the same chart sketch the PWi function for each alternative for i 0 and 50.

Which capital investment evaluation technique is described by the following characteristics. Building either a gas station or a restaurant on a corner lot. Which of the following capital investment models would be preferred when choosing among mutually exclusive alternatives.

C The elite investment opportunities will get chosen. C Multiple incremental IRRs might exist. Buy a machine that requires an initial investment outlay of 100000 and will generate CFAT of 30000 per year for 5 years.

The term mutually exclusive investments mean. The following mutually exclusive projects are available. Xpert Engineering Ltd.

2 May result in multiple answers. D There are no investment options available. Accounting rate of return c.

See Table P6-82 The life of all alternatives is 10 years. Which one of the following best expresses two mutually exclusive investments. Cash flow in year 1.

Cash flow in year 1. It is commonly used to describe a situation where the occurrence of one outcome supersedes. Year We have two mutually exclusive investments with the following cash flows.

A Problems can arise using the IRR method when the mutually exclusive investments have different cash flow patterns. Project PW Costs PW Benefits A 1 500 000 2 400 000 B 1 800 000 1 900 000 900 000 1 800 000 D 2 700 000 4 200 000 E 2 100 000 1 900 000 O a. Alternative Initial cost Net Annual Revenues Service life years B-C Ratio A 370000 109788 10 182 B 600000 146471 10 15 B versus A 230000 36683 10 098 Which investment is more economical.

Compute the internal rate of return for each project. Mutually exclusive is a statistical term describing two or more events that cannot happen simultaneously. You are using a net present value profile to compare two projects.

Compute the internal rate of return for each project. Under the net present value model the present value or discounted value of all future cash inflows is compared with the present value of all. Cash flow in year 1.

Is considering buying one of the following two mutually exclusive investment projects. Two mutually exclusive investment projects have the following forecasted cash flows. Independent projects are also mutually exclusive.

Each project must be mutually beneficial for other projects in the company. The following show four mutually exclusive investments. To identify which of the following two mutually exclusive investments is more economical the B-C ratio method is used at a MARR of 8 per year.

D The incremental IRR rule assumes that the riskiness of the two projects is the same. The following mutually exclusive investment alter-natives have been presented to you. B Selection of one investment precludes the selection of an alternative.

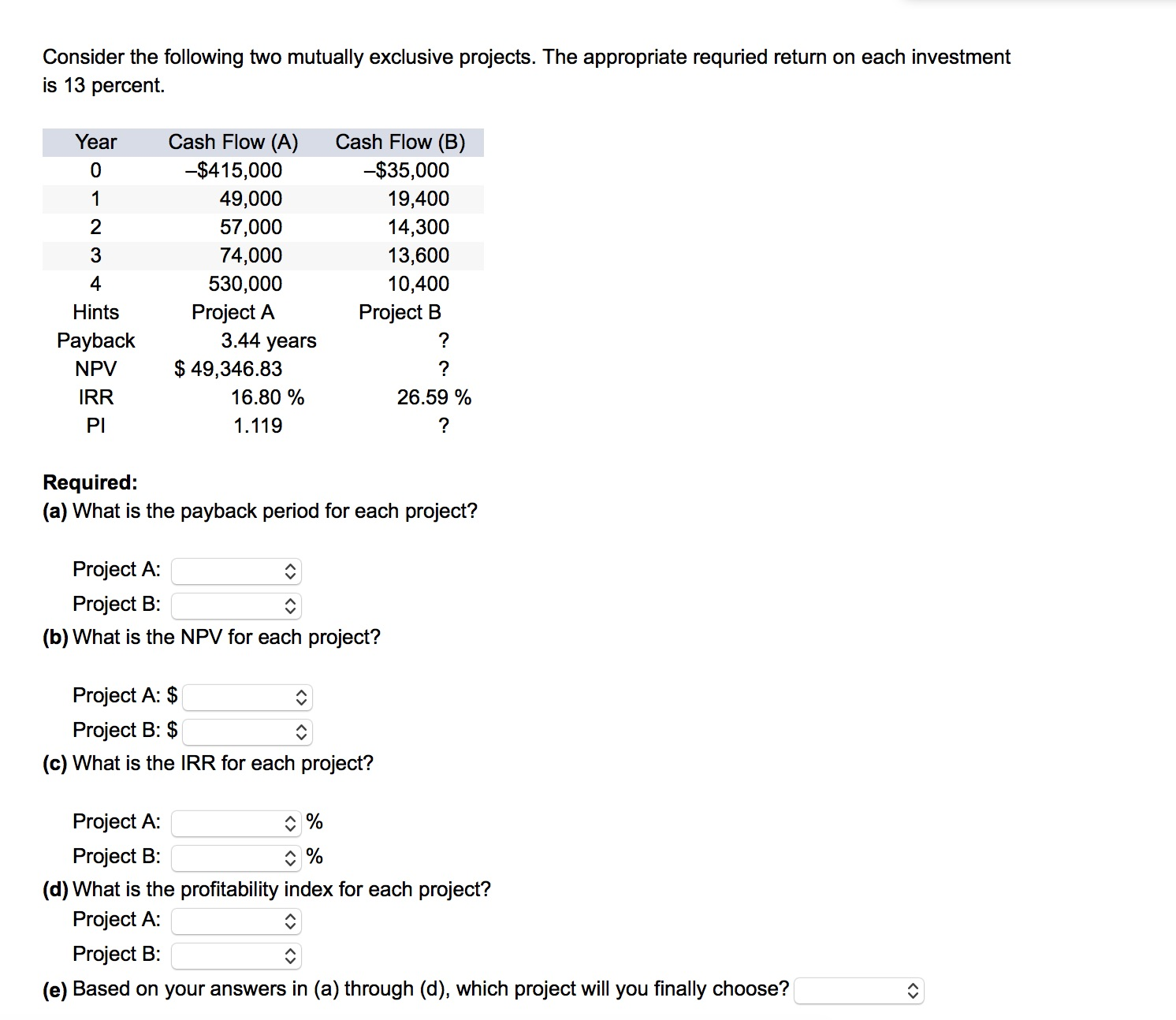

The NPV function actually calculates the present value of all cash inflows. A ObC OB OdD. Consider the following two mutually exclusive investment projects.

When evaluating two mutually exclusive investments the best method to use is the. The present value of an investments cash inflows divided by the investments initial cost is called the. Alternative х Y Y versus X Initial cost 370000 600000 230000 Net Annual Revenues 89284 131444 42160 Service life years 10 10 10 B-C Ratio 162 147 123 Which investment is more economical and how in.

B The IRR is affected by the scale of the investment opportunity. To identify which of the following two mutually exclusive investments is more economical the B-C ratio method is used at a MARR of 10 per year. 91 B Initial investment.

Solved Capital Budgeting 1 A Company Is Evaluating Chegg Com

The Sharpe Ratio Standard Deviation Finance Ratio

Solved Question 1 18 Marks You Are Considering The Chegg Com

Pin On Temple Mount Christian Center Inc

Mutually Exclusive Projects How To Evaluate These Projects Examples

Introduction To Income Statements For Stock Investors Dummies Income Statement Income Investors

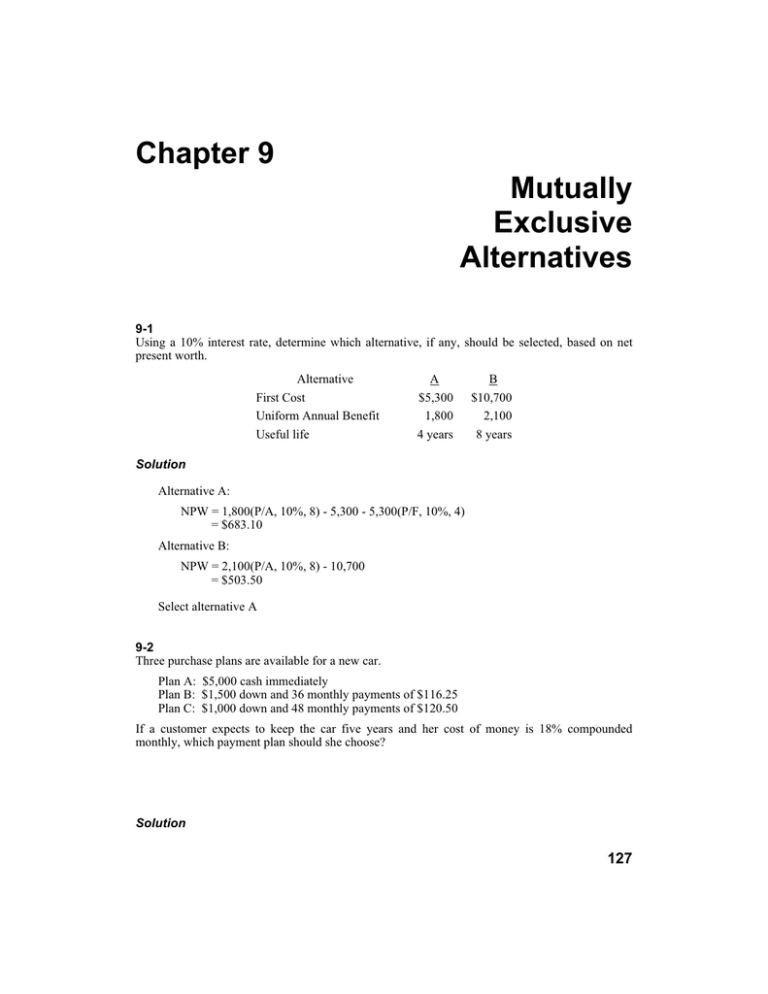

Chapter 9 Mutually Exclusive Alternatives

More Video Streaming Options Won T Change Consumer Behavior Emarketer Trends Forecasts Statistics Consumer Behaviour Video Streaming Streaming

Www Getrichslowly Org Blog 2015 06 16 Life After Debt Experimenting With Financial Balance Investing Roth Ira Budgeting

10 Companies You Ve Never Heard Of Control More Than 50 Of The Biggest Restaurant Chains In The World In 2022 Restaurant Branding Seattle Best Coffee Yum Brands

Luxury Fashion Independent Designers Ssense Polyvore Fashion Luxury Fashion

Pin By Nurul Farihah On Style Loafers Outfit How To Wear Loafers Women How To Wear Loafers

Don T You Just Love Sundays Sundayfunday Today Love Chill Aroundtheworld Hiking Gym Fun Relax Enjoy Great Weekend Party Just Love People Greats

3 Business Networks Your Company Should Have Elmens Business Finance Business Loans Investing

Solved Consider The Following Two Mutually Exclusive Chegg Com

X Ways Winhex V13 8 Sr 4 Zwt Suncouchurch Stock Market Marketing Billions Showtime

Irr Internal Rate Of Return Rule And Mutually Exclusive Investments Timing Of Cash Flows Issue Welcome Futurumcorfinan

Comments

Post a Comment